Truth be told, you are left with no option but to invest because Stagnation is like death for money. If your savings are not growing at a rate to beat inflation, you may be burning up your hard-earned cash. It’s losing value with passing time.

Inflation i.e. increases in the price of goods & services with time; effectively decrease the number of goods and services you can buy with a rupee in the future as opposed to a rupee today. What was worth 100 rupees last year is probably worth 105, 110, or even 120 next year? Inflation eats away your savings bit by bit by reducing the purchasing power of money.

Why Inflation occurs?

To grow economically, a country has to produce more goods and services i.e. GDP (Gross Domestic Product). If the GDP grows, the number of transactions increases resulting in demand for more money. If the government or central bank refuses to print & increase the money supply, the value of existing money would increase and prices would fall.

If the government increases the supply of money and due to one of the interior or exterior crises the GDP drops or if the supply of money in the economy is faster than the GDP growth, then more money will be available for the same GDP resulting, the value of the existing money to decrease and prices to rise.

In the present economic model around the world, inflation is unavoidable & central banks (like the Reserve Bank of India) today primarily use inflation targeting to keep economic growth steady and prices stable. If inflation rises, raising interest rates, or restricting the money supply are both contractionary, monetary policies designed to lower inflation.

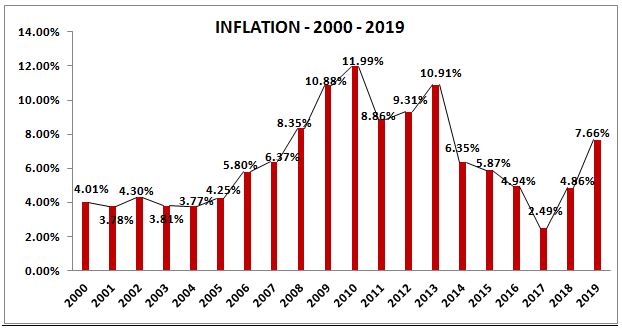

Inflation as measured by the ‘consumer price index’ (CPI) reflects the annual percentage change in the cost to the average consumer of acquiring a basket of goods and services for specific intervals such as yearly.

Historical CPI inflation in India from 2000 to 2019 (Source: World Bank)

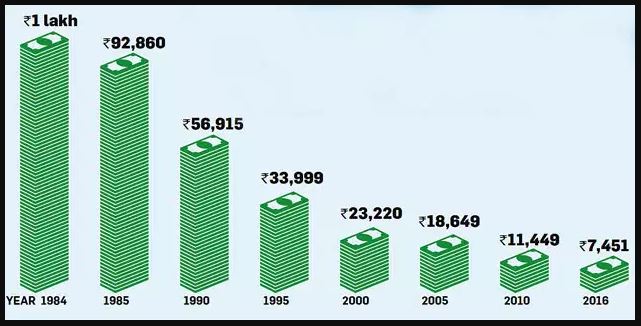

Economic times article titled – “ Rs 1 Lakh in 1984 is just Rs 7,451 now: Are you saving enough to beat inflation”? Emphasizes how the purchasing power of money has degraded from Rs 1 Lakh in 1984 to just Rs 7,451 by 2016 because of years of inflation. In other words, what was use to cost 7,451 in 1984 now costs 1 Lakh Rs in 2016.

“It is not the goods & services that have become costlier; it is the money that has become cheaper”.

As long as our saving does not grow at a rate to beat inflation you will be much poorer in the long run. We all know this subconsciously! But even then we fail to incorporate this knowledge into our savings.

Since each year’s inflation is more than last year’s inflation, it means the effect is the same as that of compound interest. People understand and appreciate the compound interest but most people do not appreciate the de-compounding effect of inflation.

What compound interest gives, inflation takes away. Most of us need to understand this math and act upon it before it’s too late. This may not be urgent but can’t be overlooked.